Taxes Settings

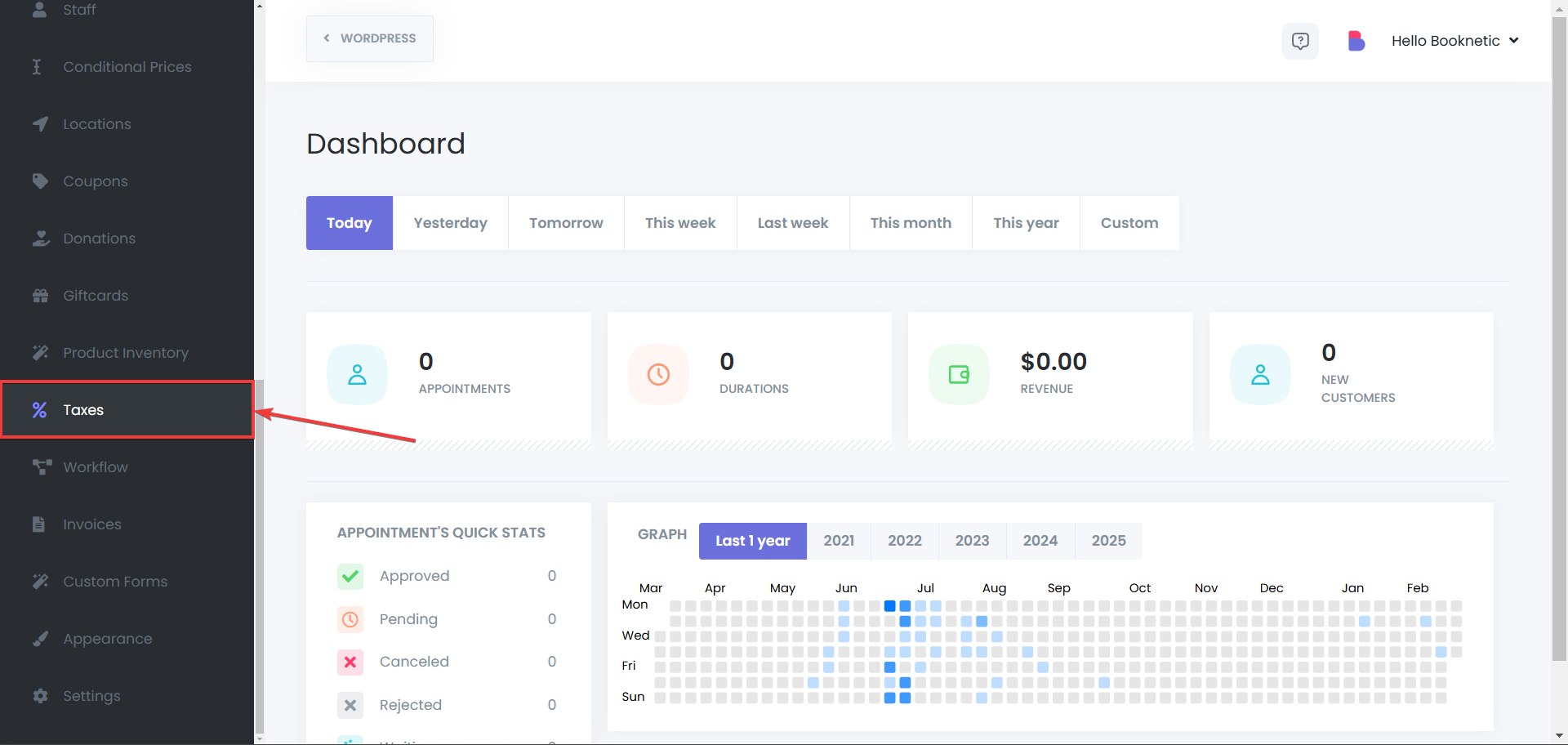

Taxes

Taxes

The Taxes Module in Booknetic allows businesses to configure and apply taxes to services based on specific rules. Whether your business operates globally or in multiple regions with varying tax laws, this feature helps automate the tax calculation process during bookings and appointments.

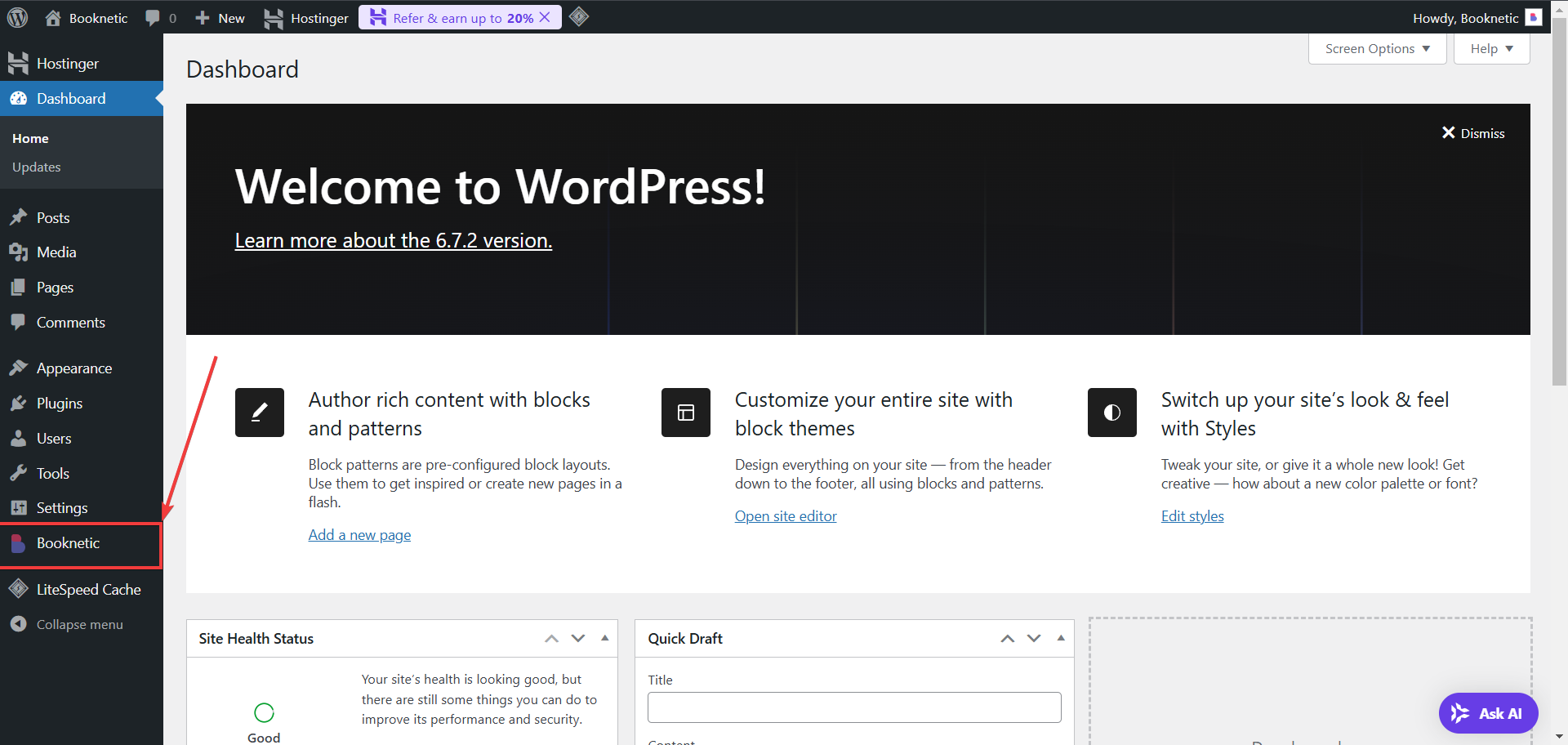

Log in to Your WordPress Dashboard

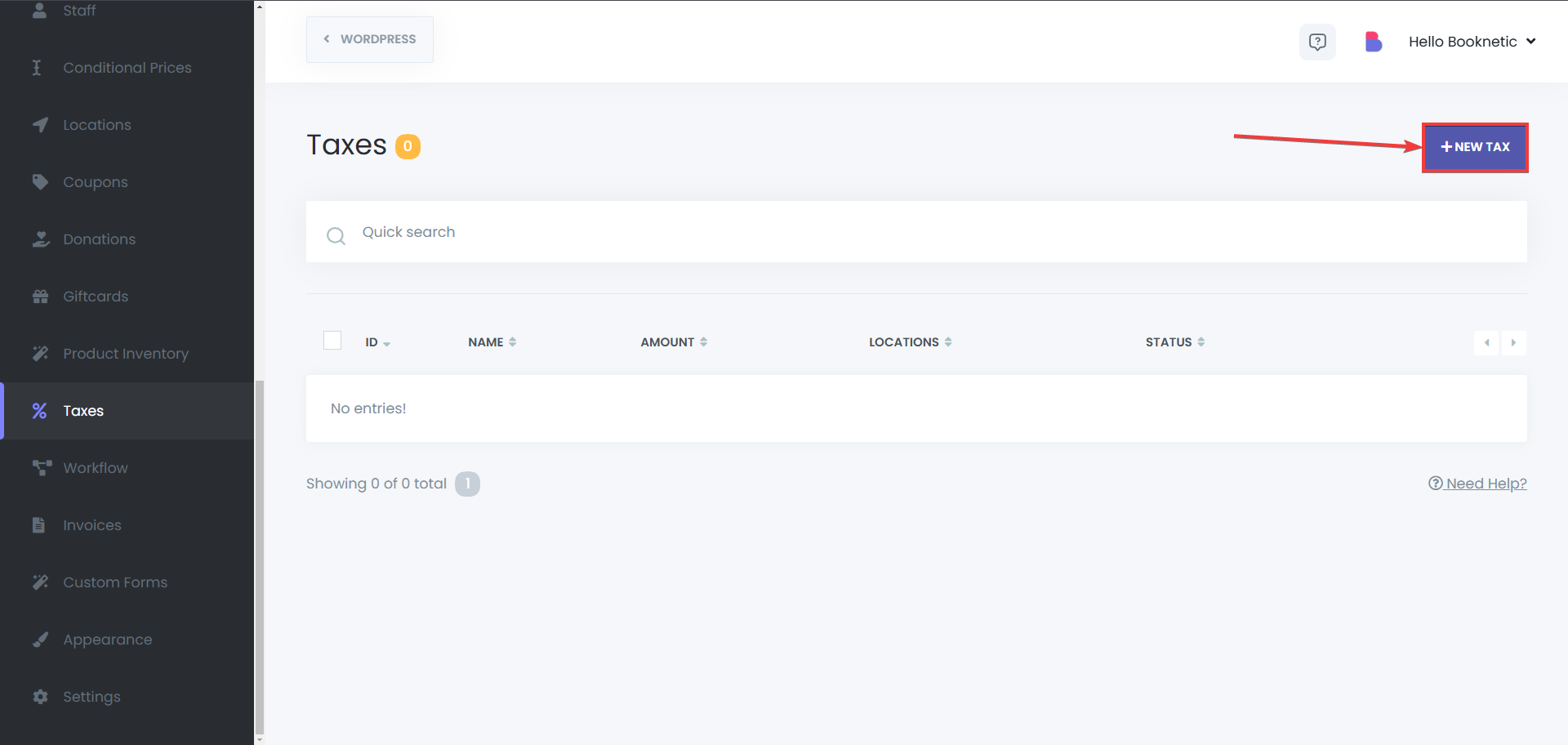

Add a New Tax Rule

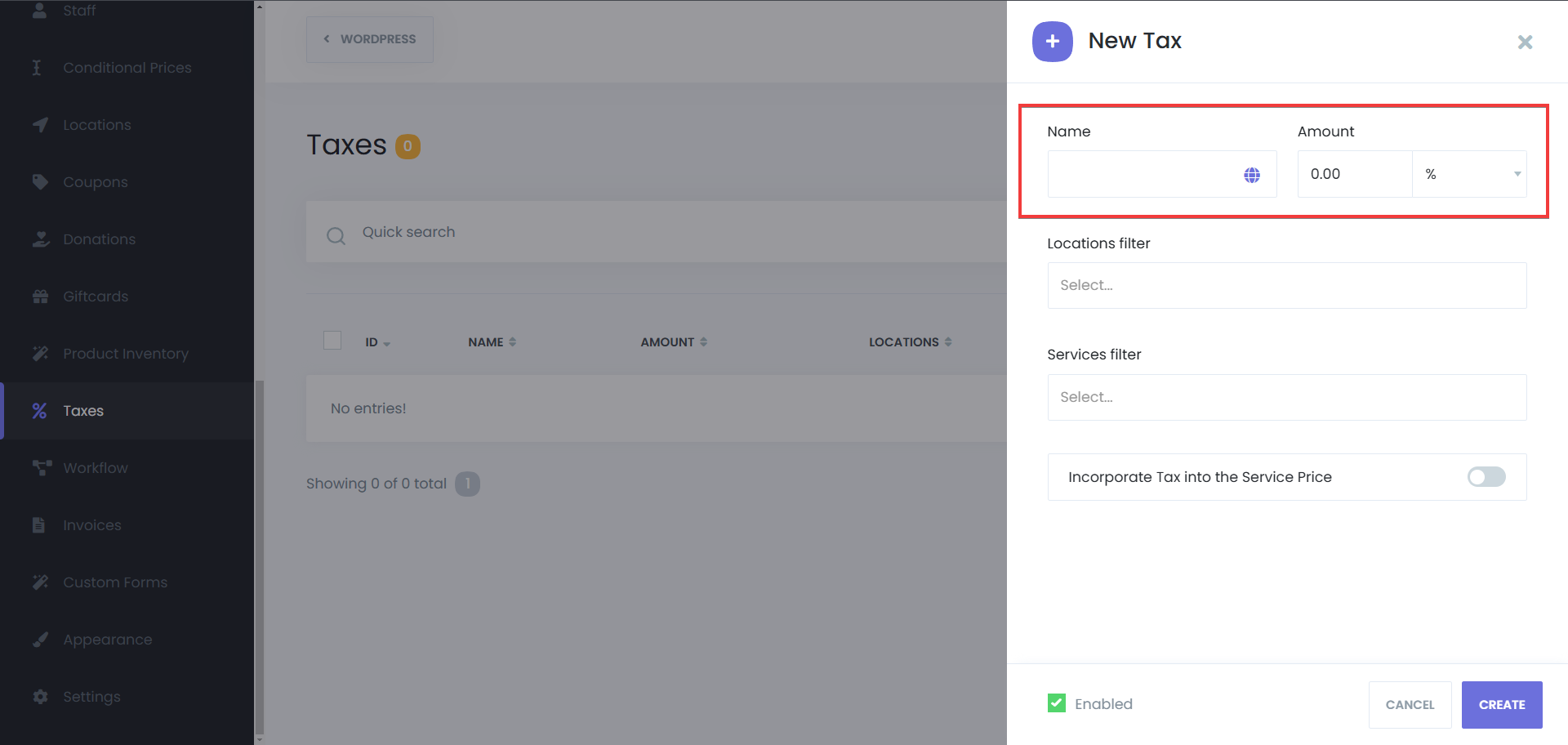

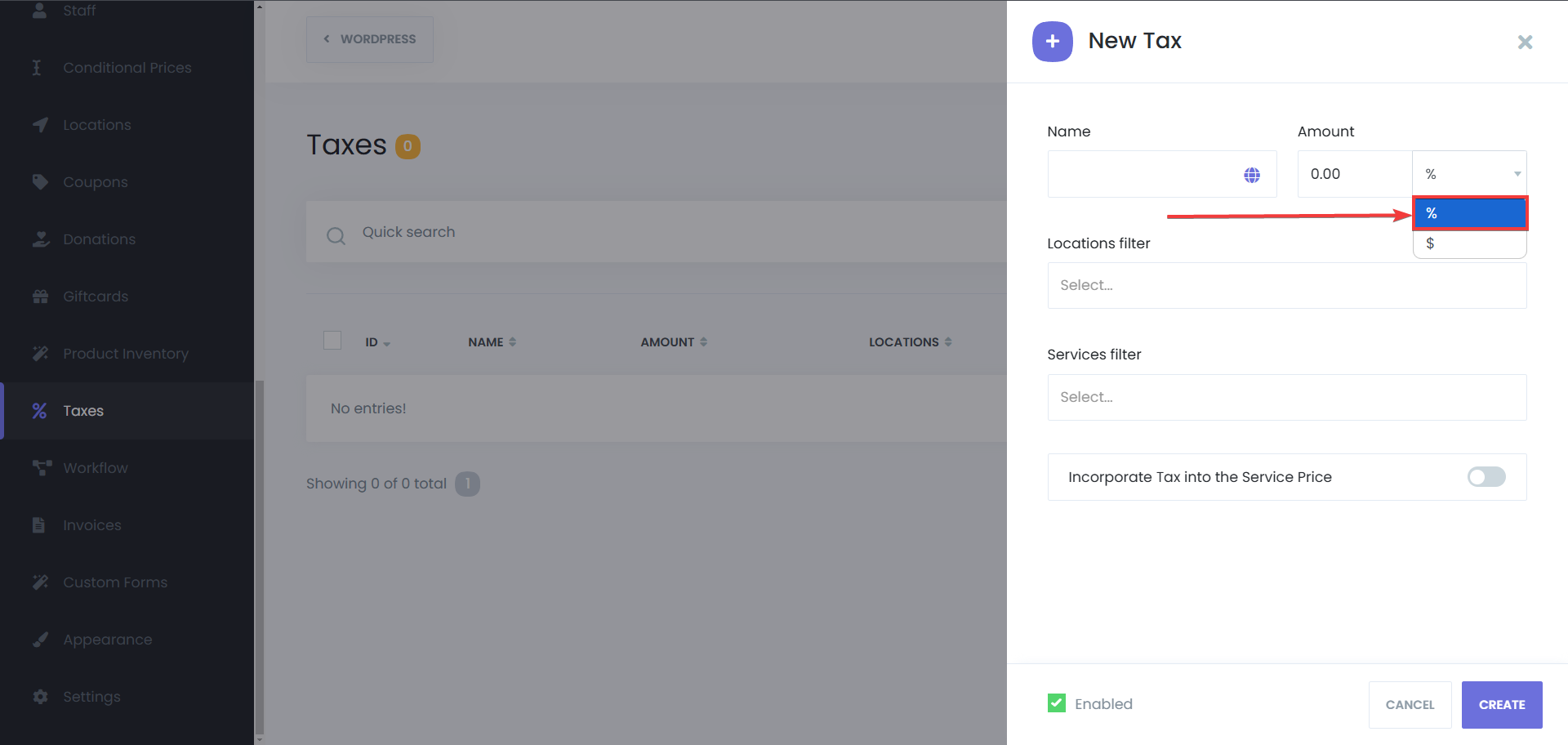

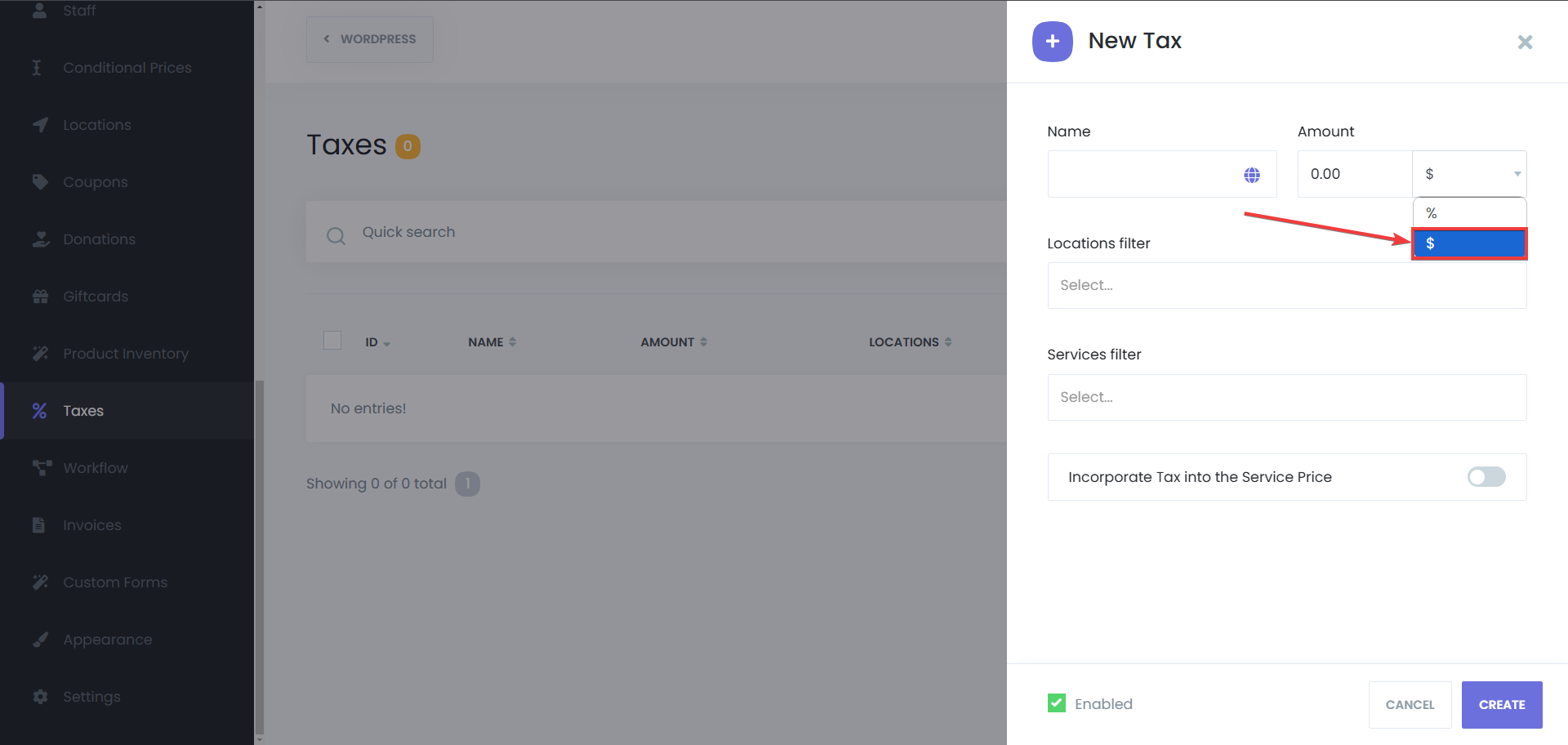

Choose the Tax Type

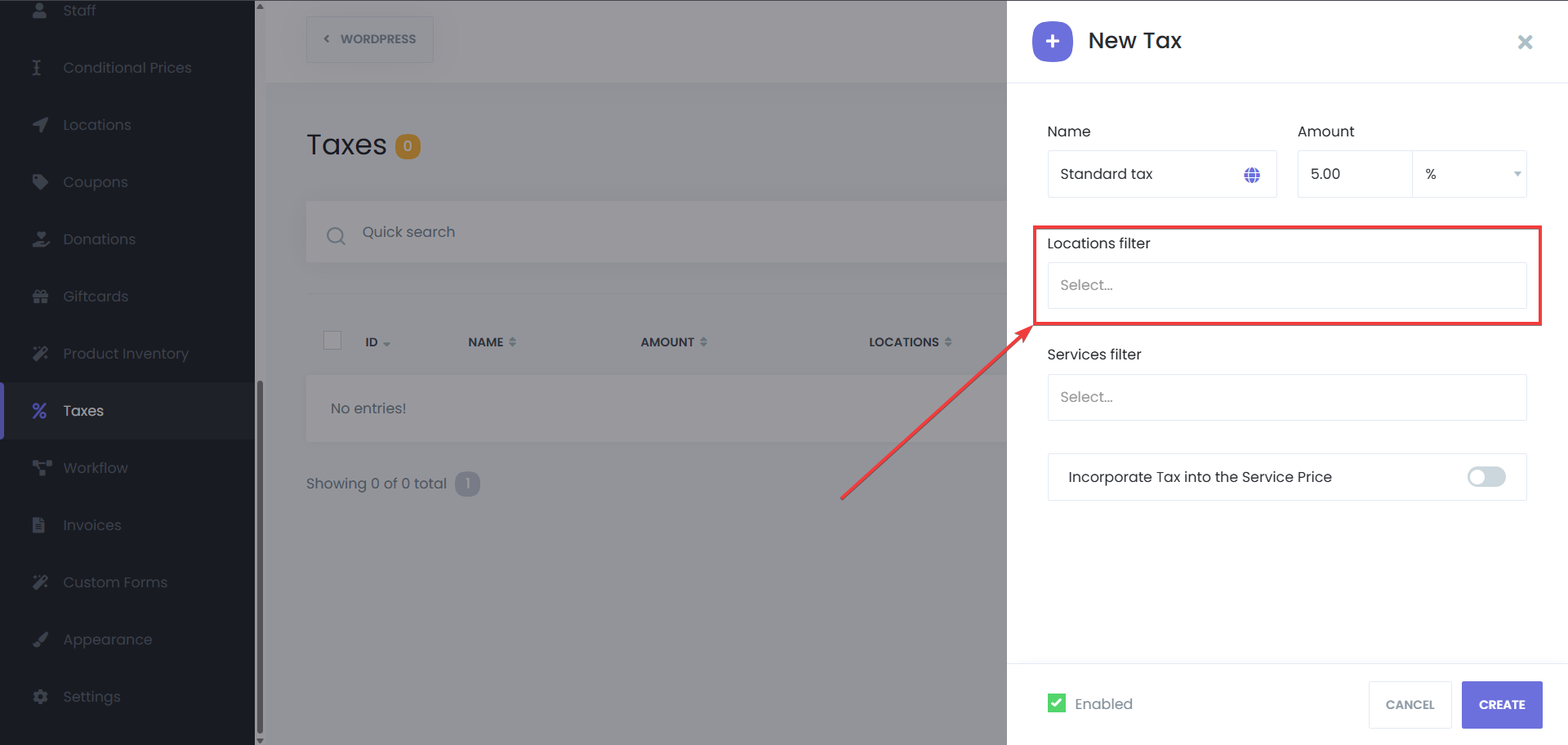

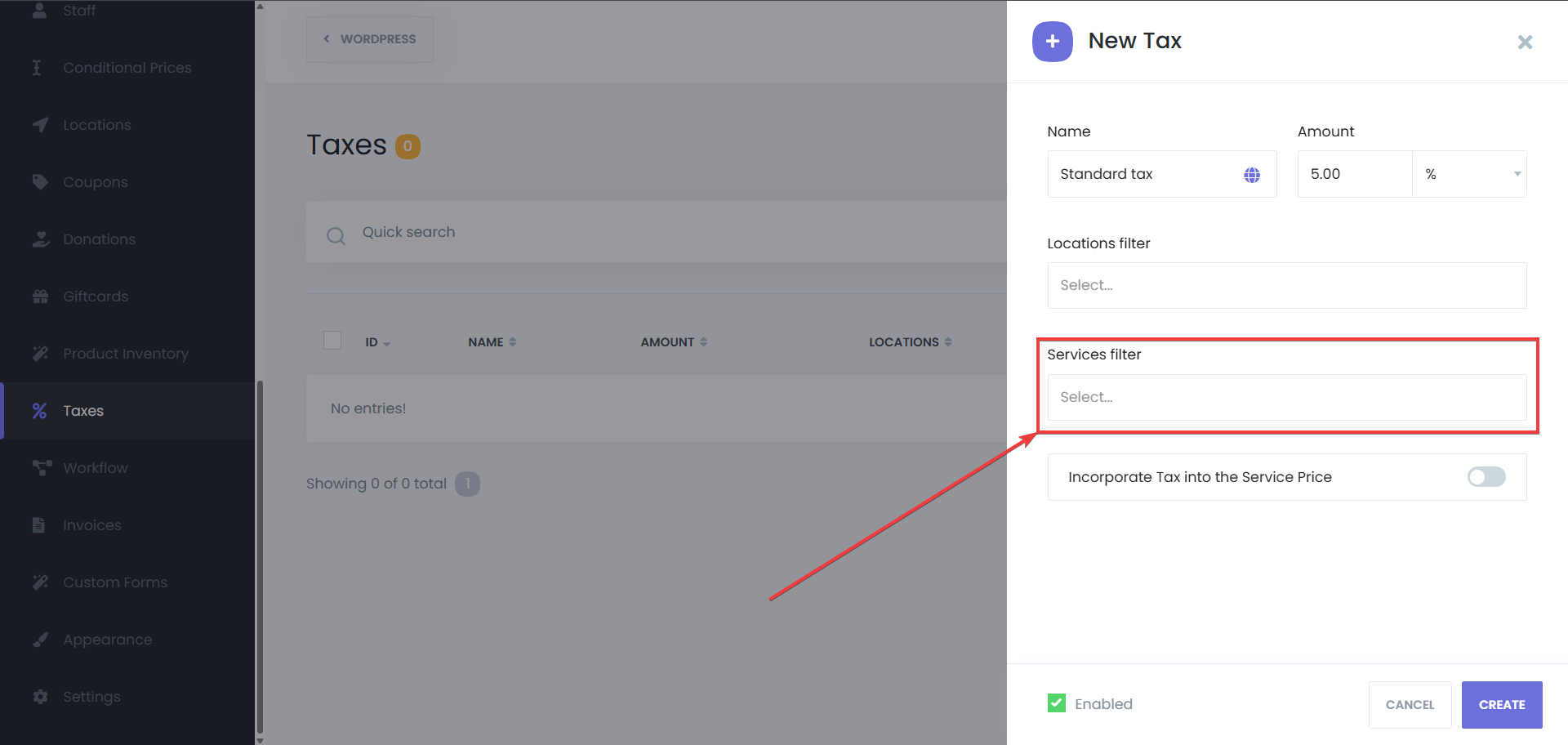

Apply Tax for Specific Services or Locations (Optional)

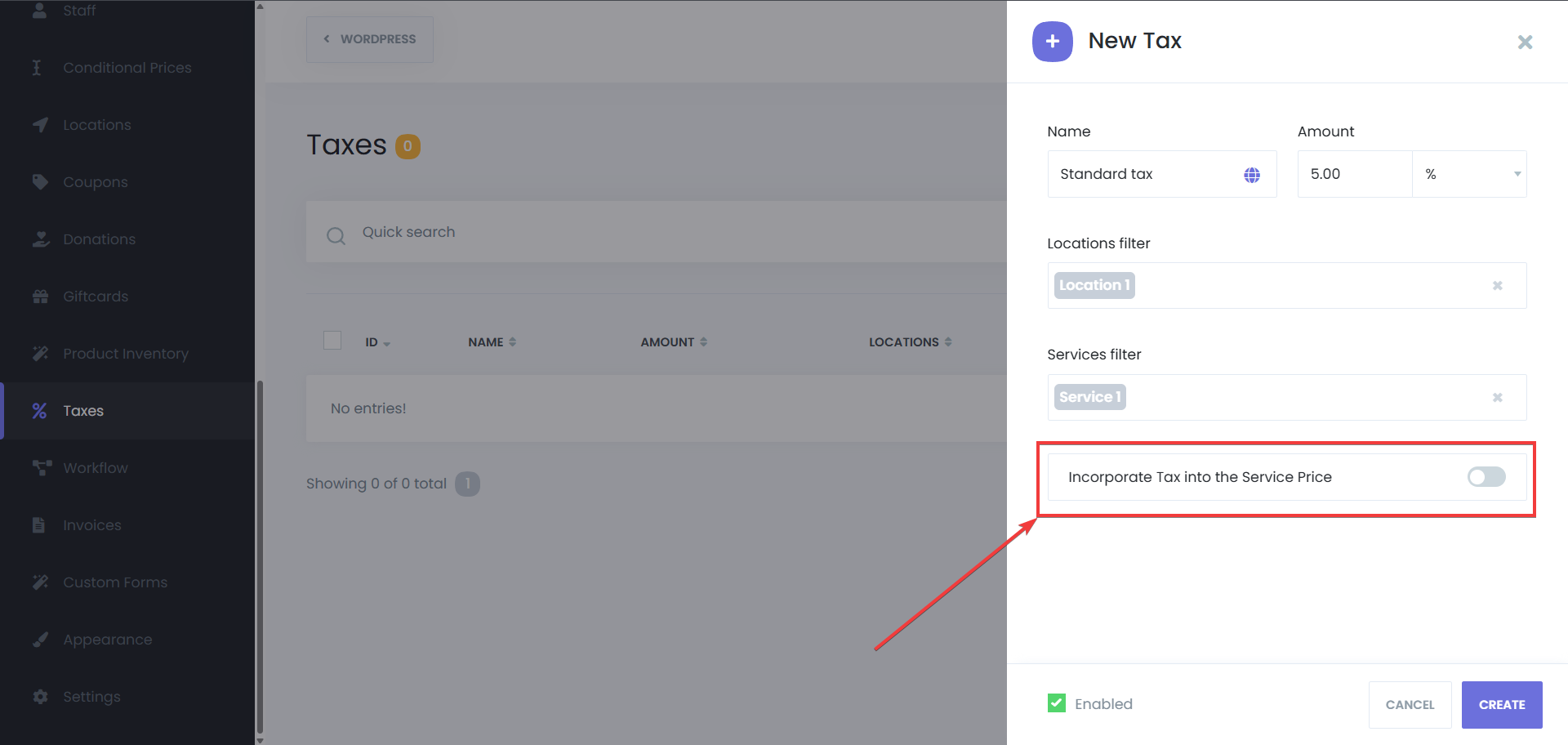

Incorporate Tax into the Service Price (Optional)

Toggle the option for incorporating the tax into the service price, if needed

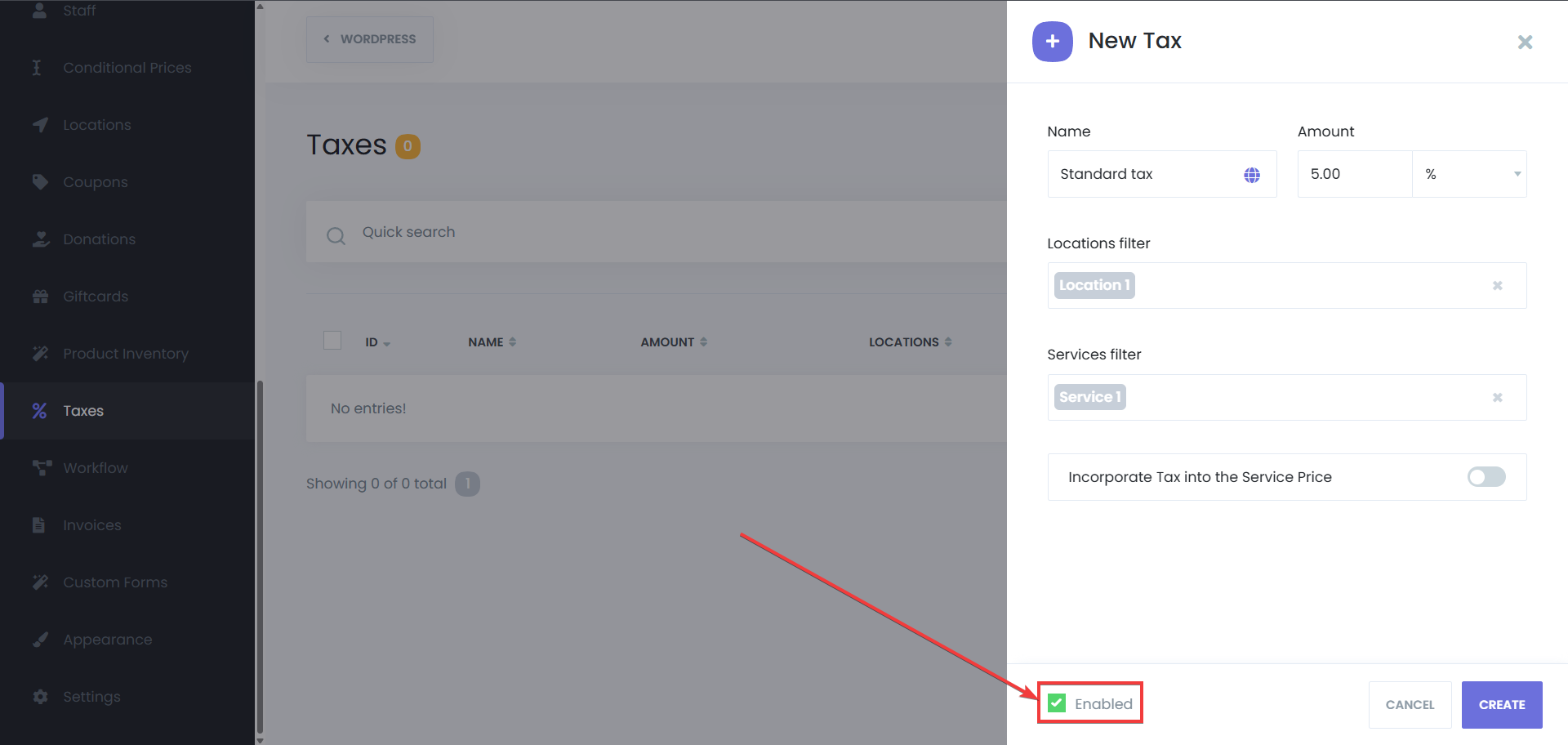

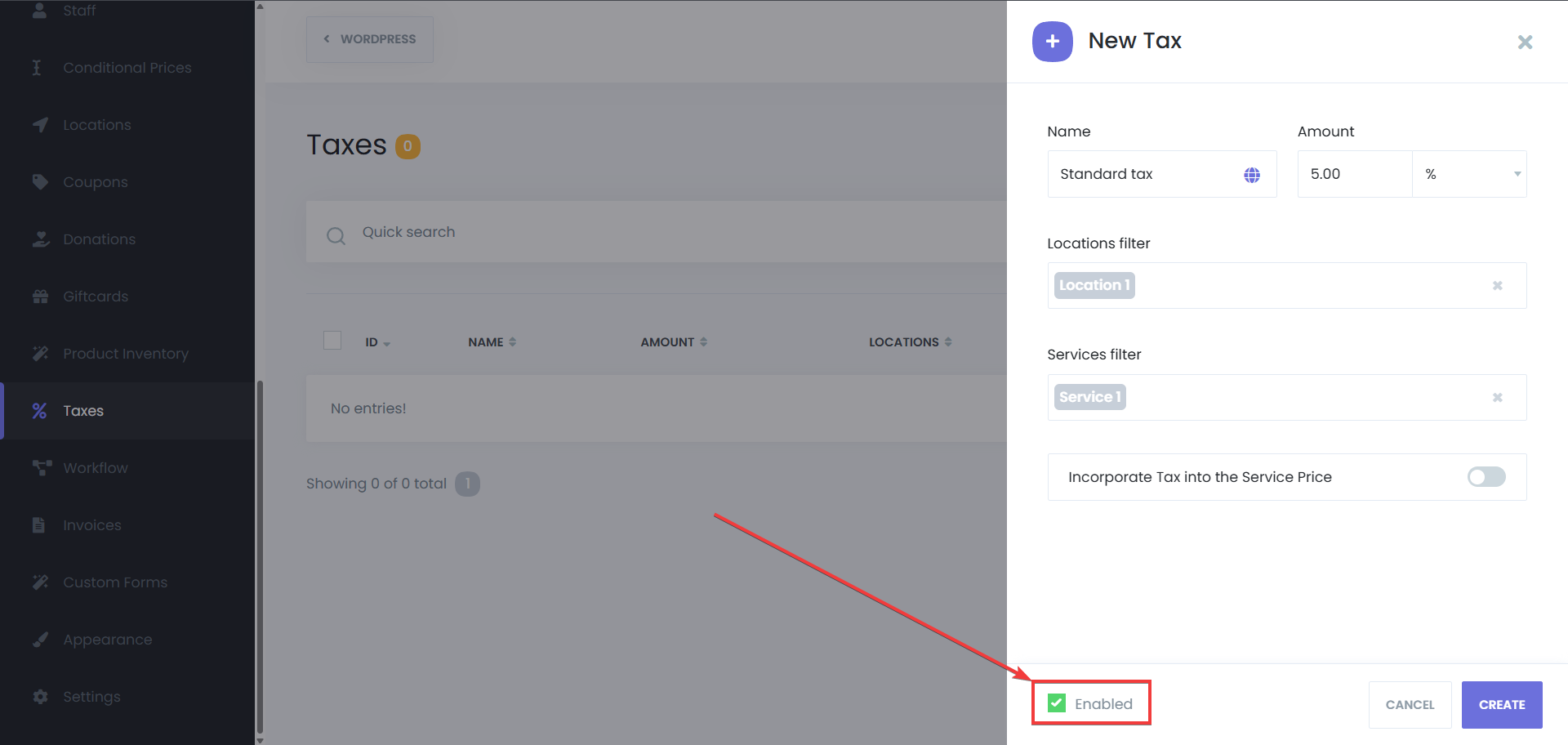

Enable or disable the tax (Optional)

Toggle the option for enabling the tax, if needed. When a new tax is added, it is enabled by default.

Save the Tax Rule

After entering all the details, click "Save" to finalize the tax rule. However, if you change your mind and don’t want to add this tax rule, you can click on the “Cancel” button to stop the process.

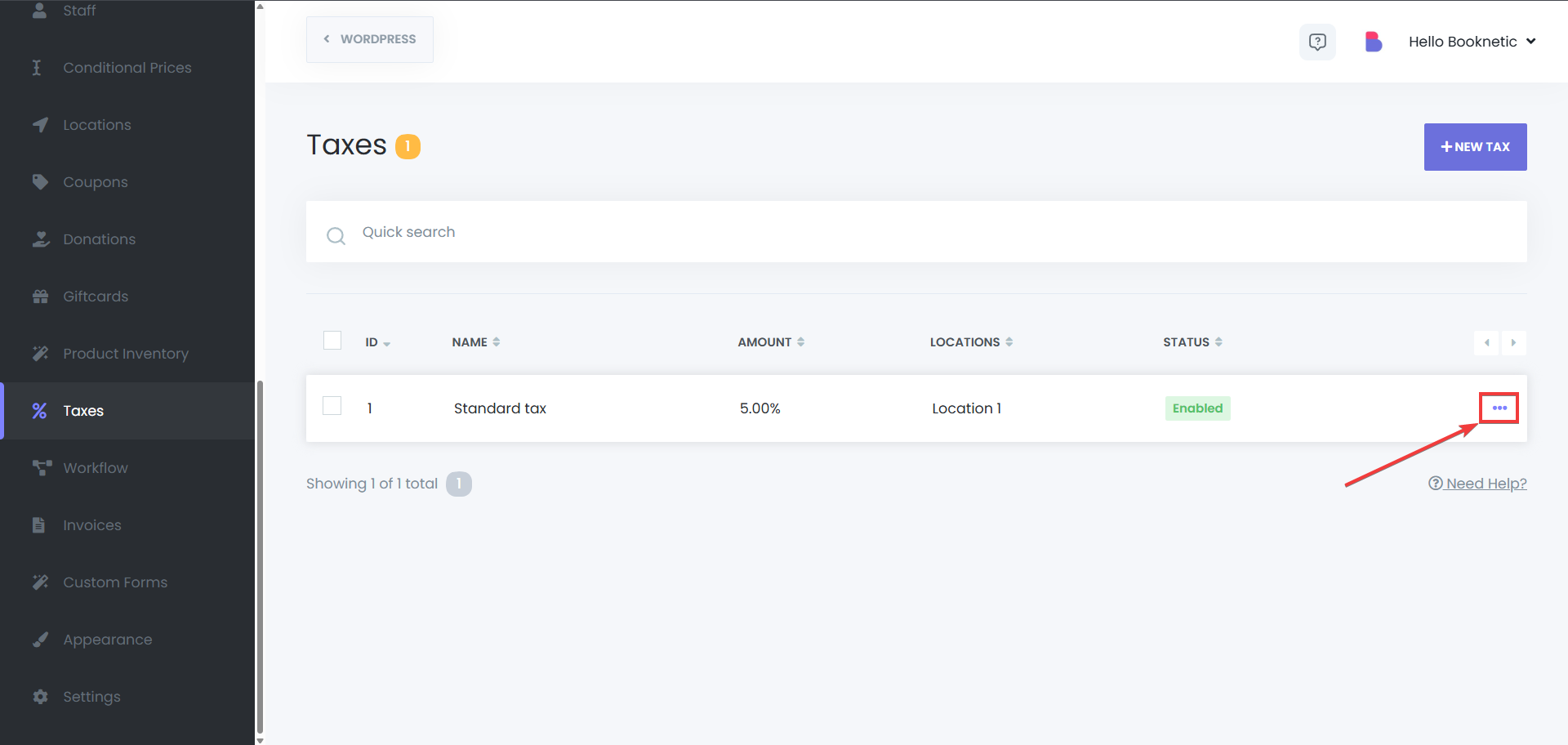

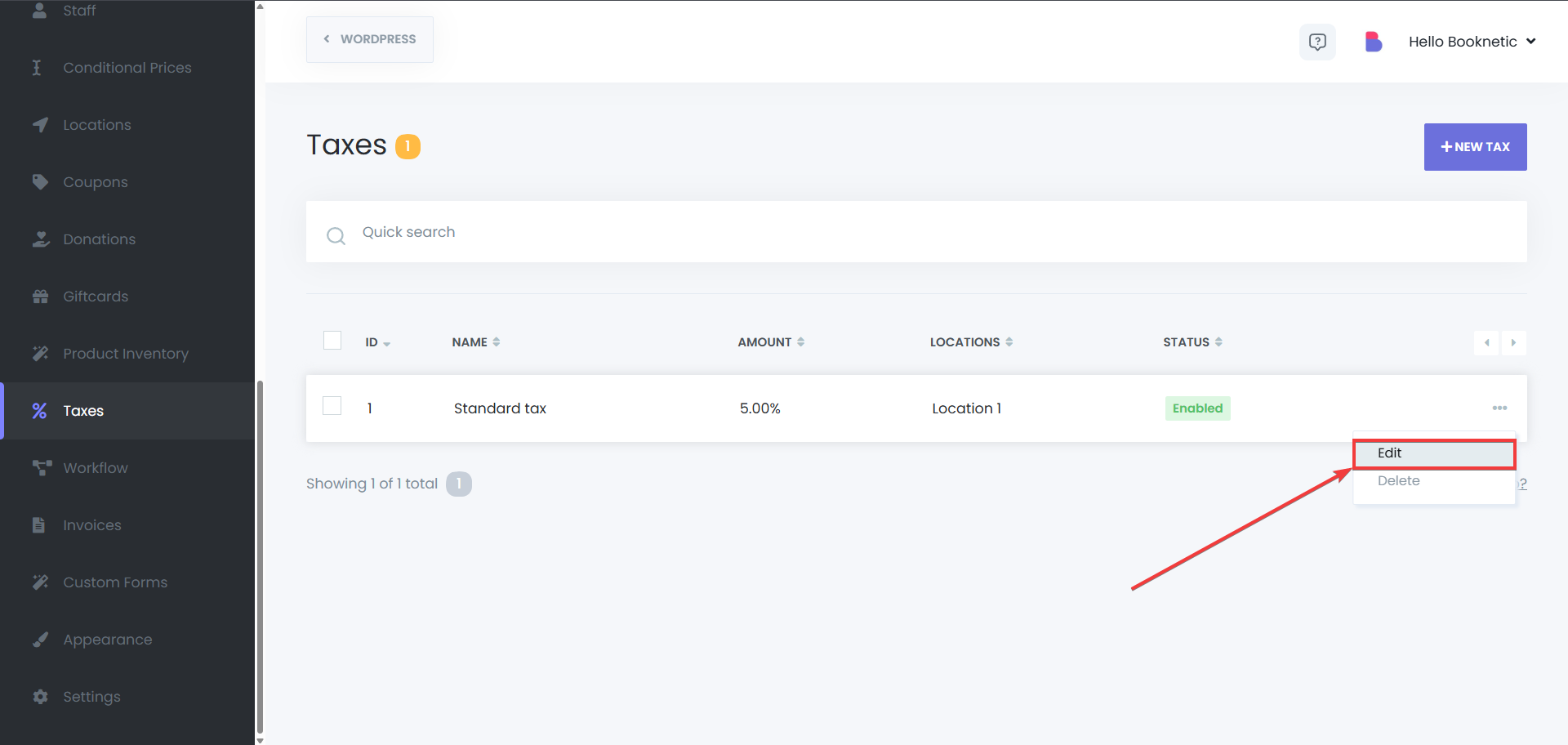

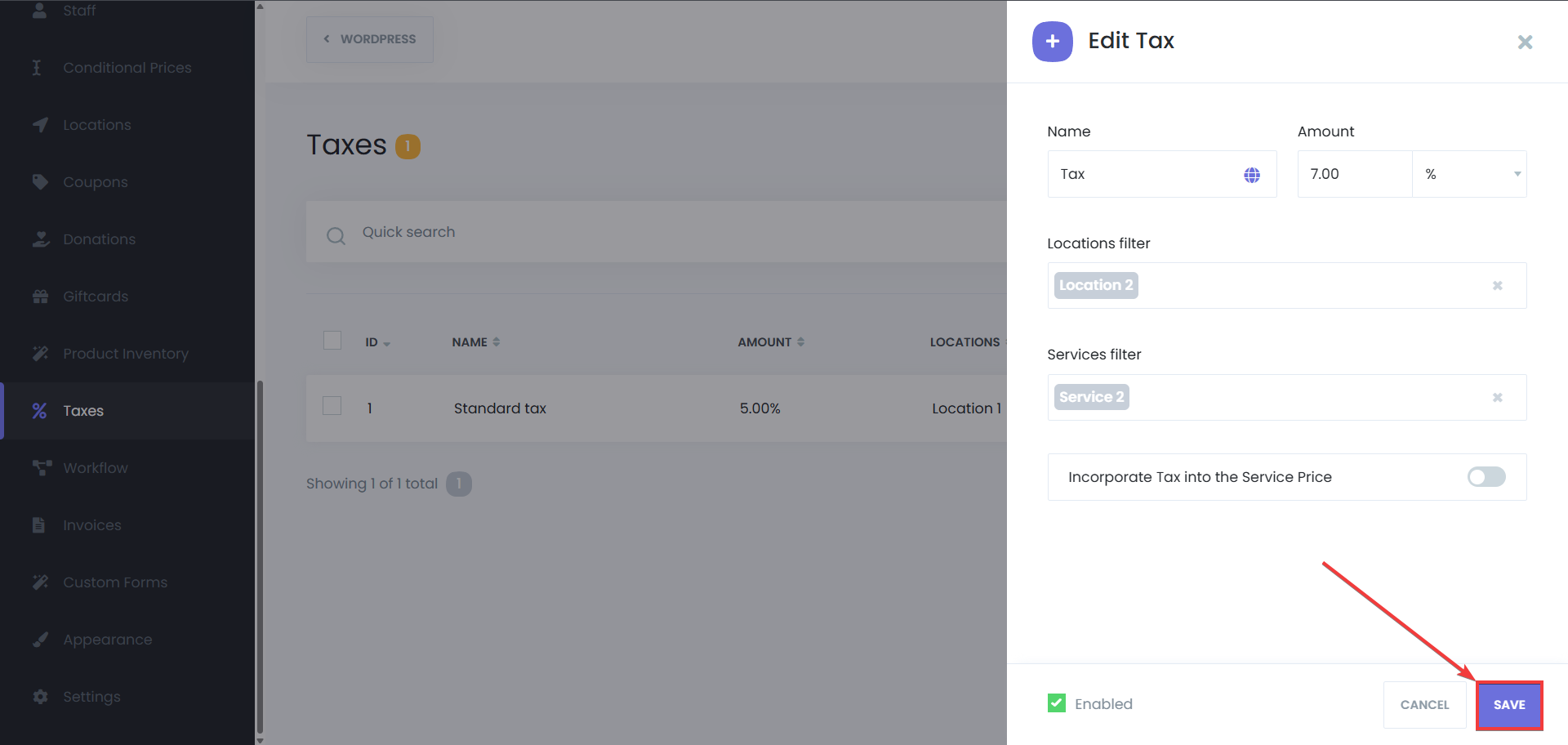

Editing a Tax Rule

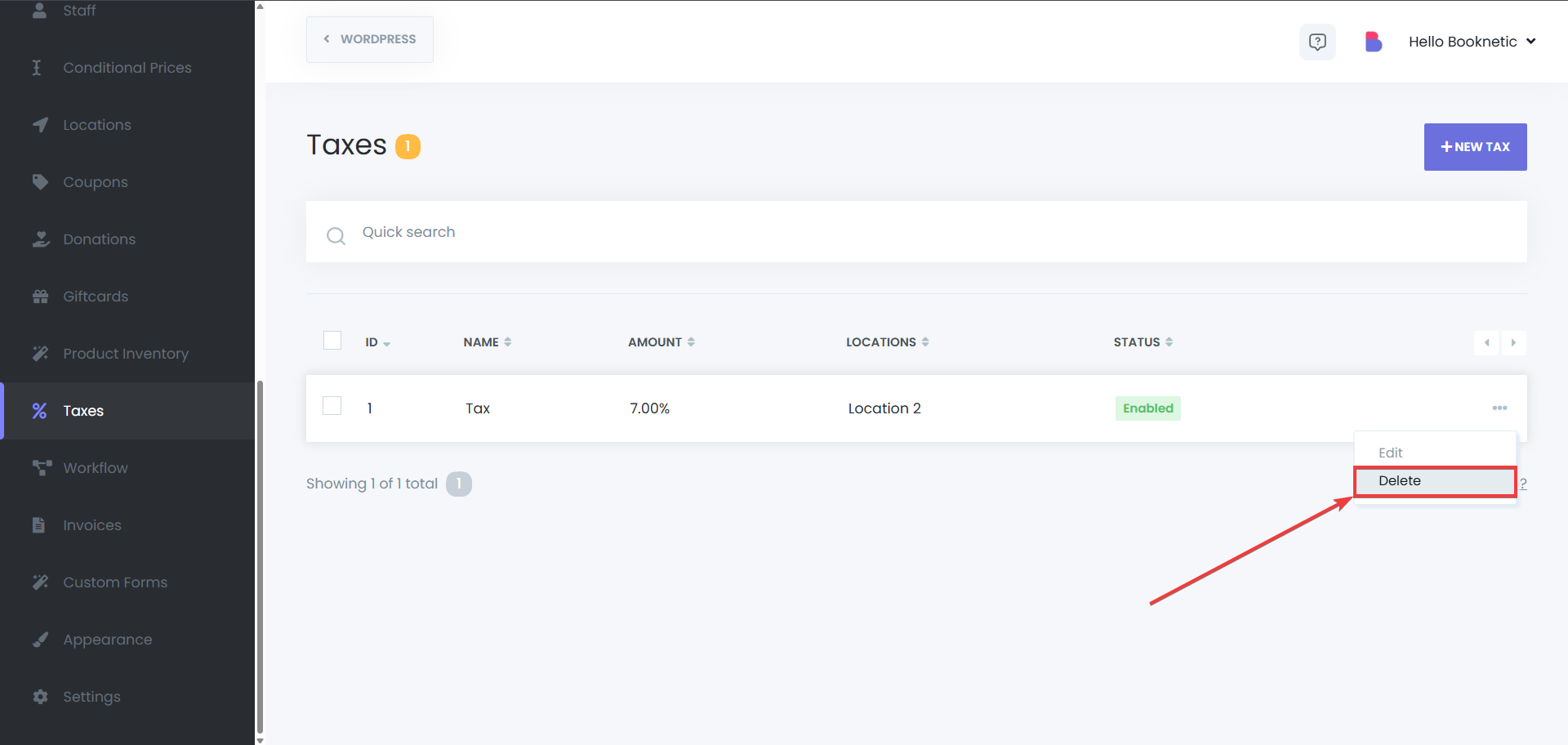

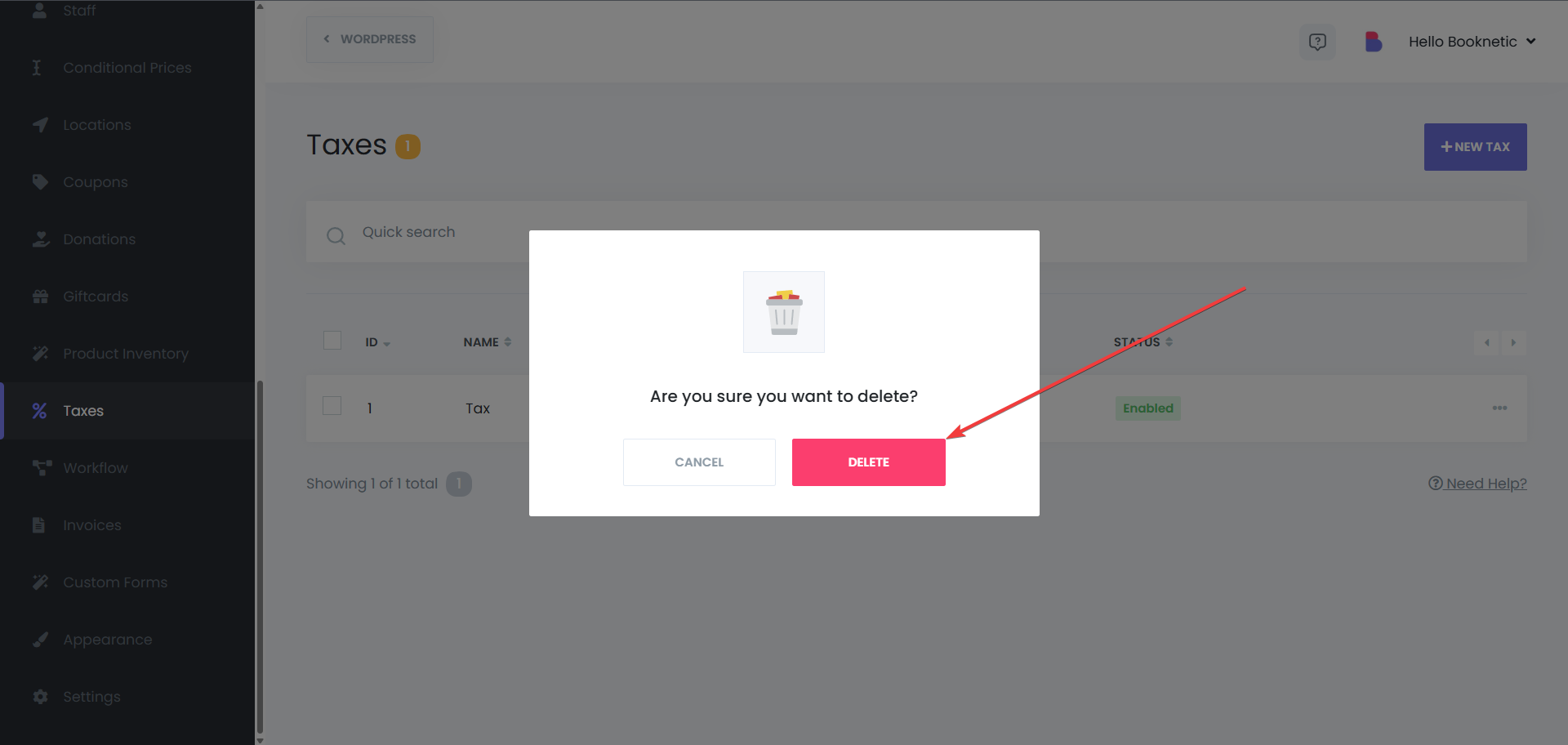

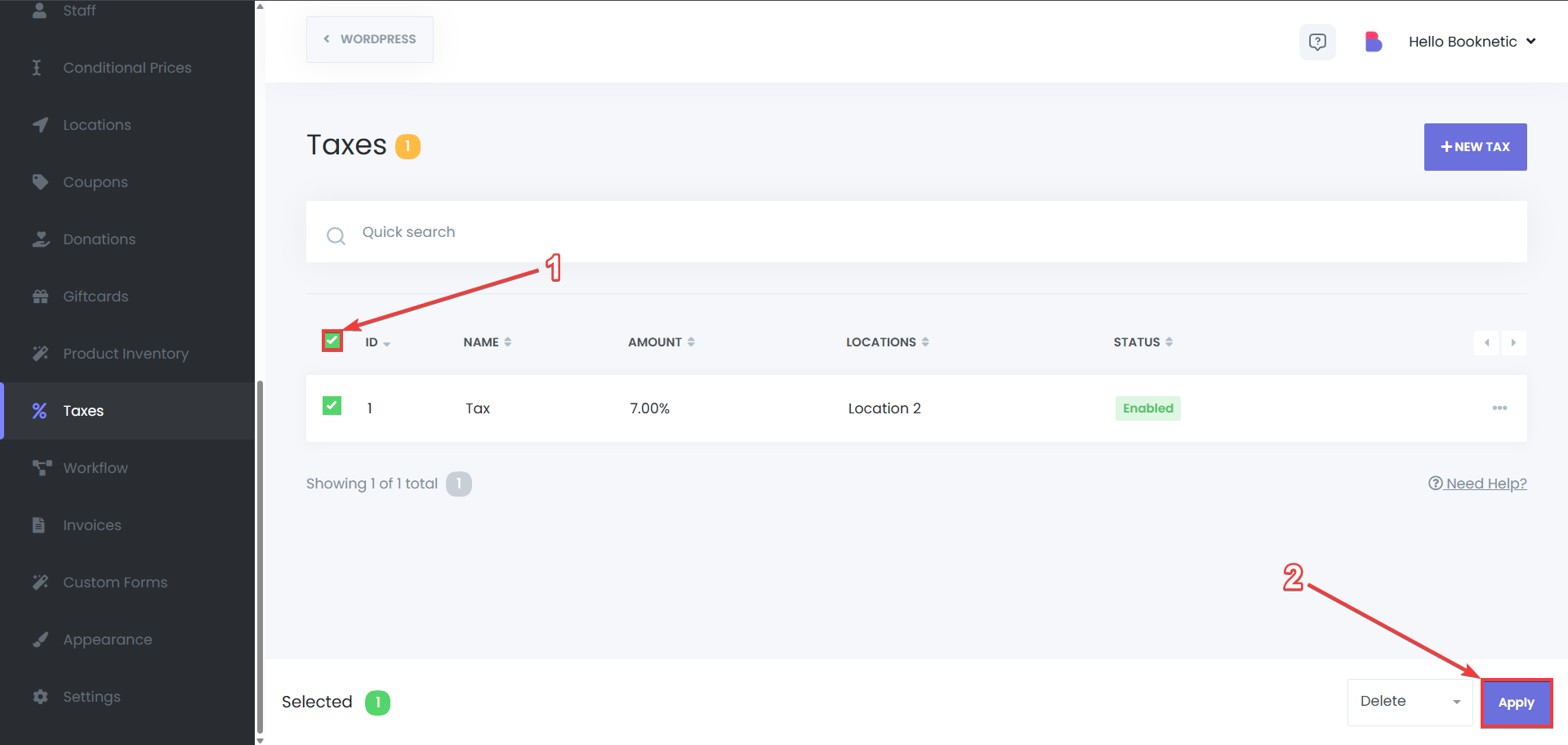

Deleting a Tax Rule

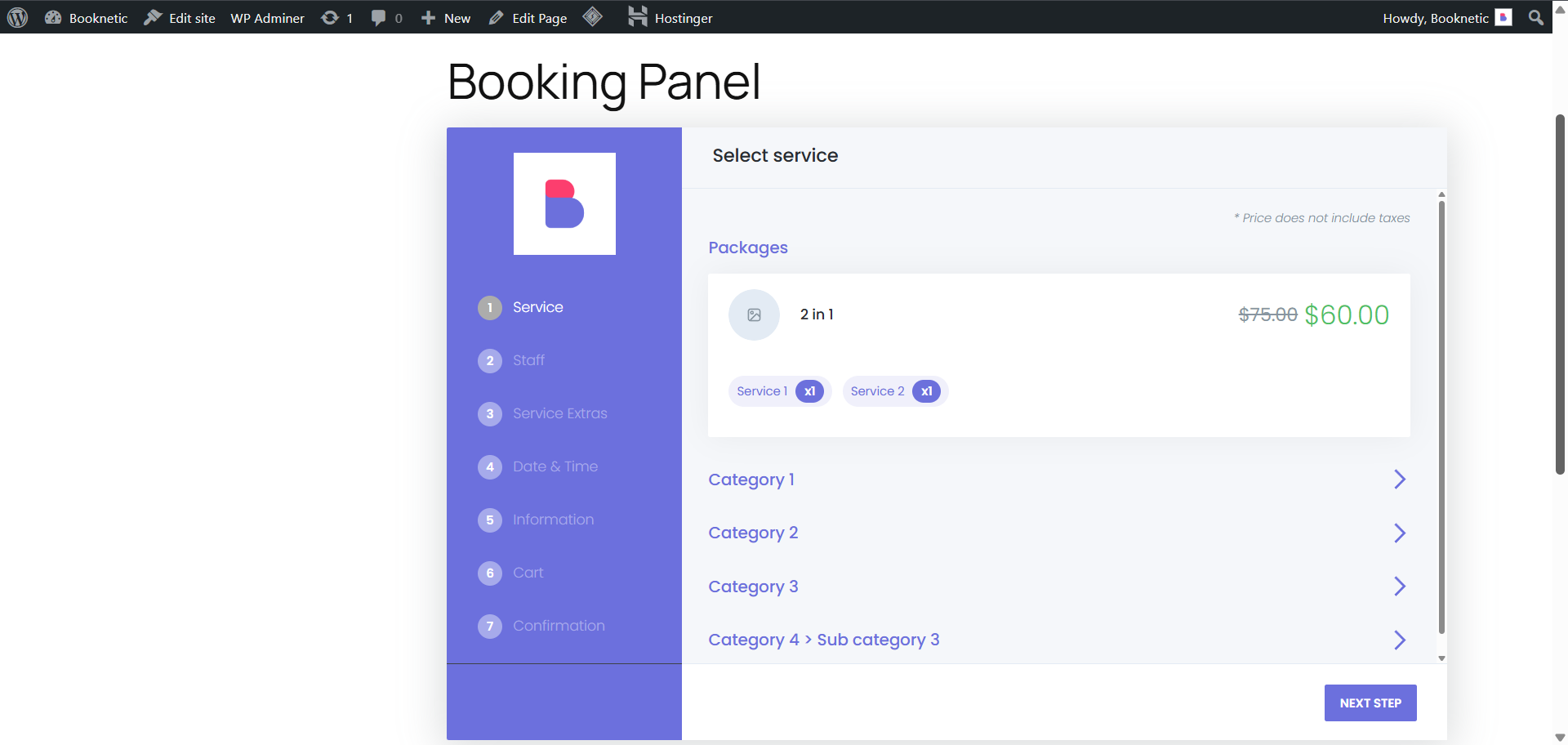

Once your tax rules are set up, they can be automatically applied during the booking process, either from the admin panel or by customers directly through the booking panel.

Go to the Booking Panel

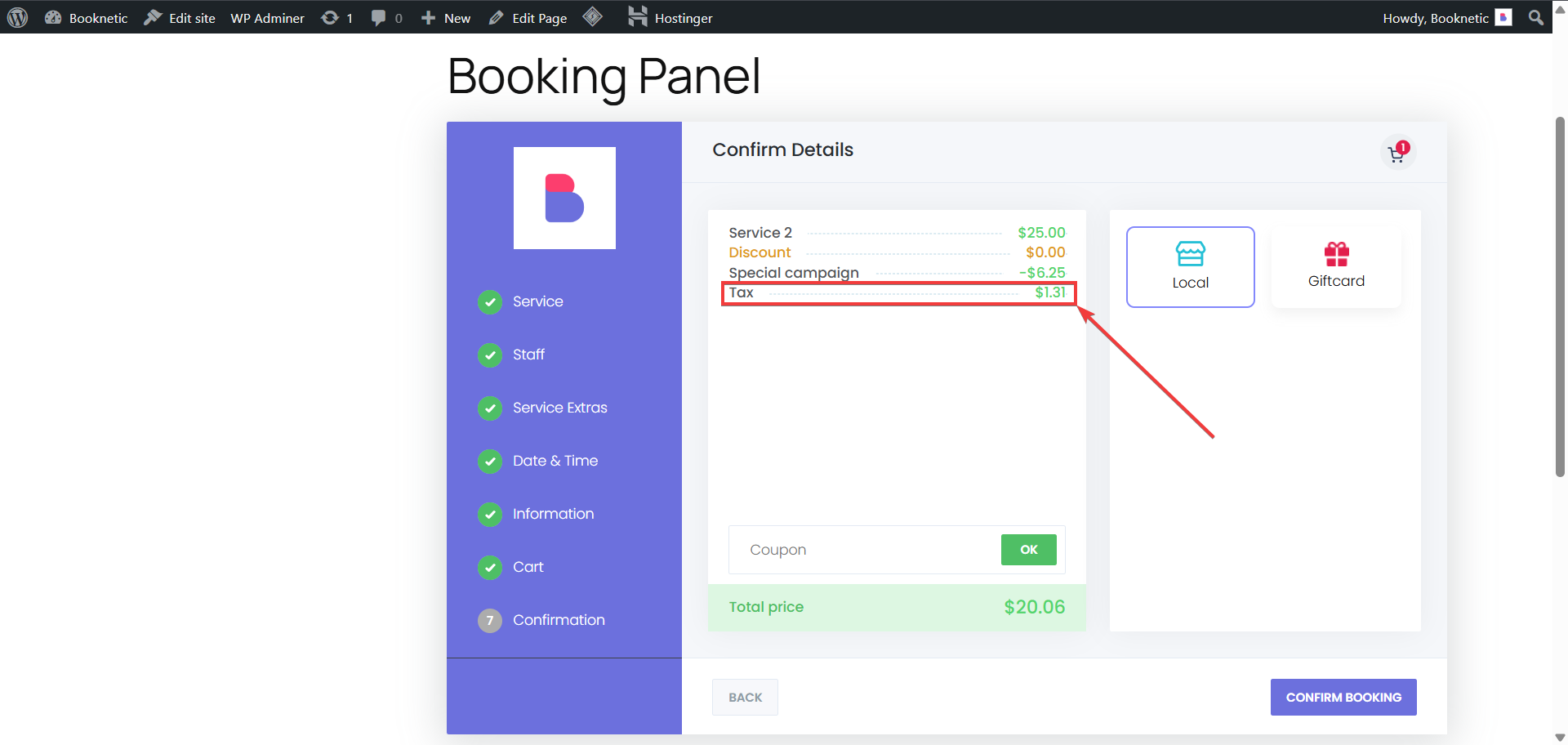

Apply the Coupon or Tax

Confirm the Appointment

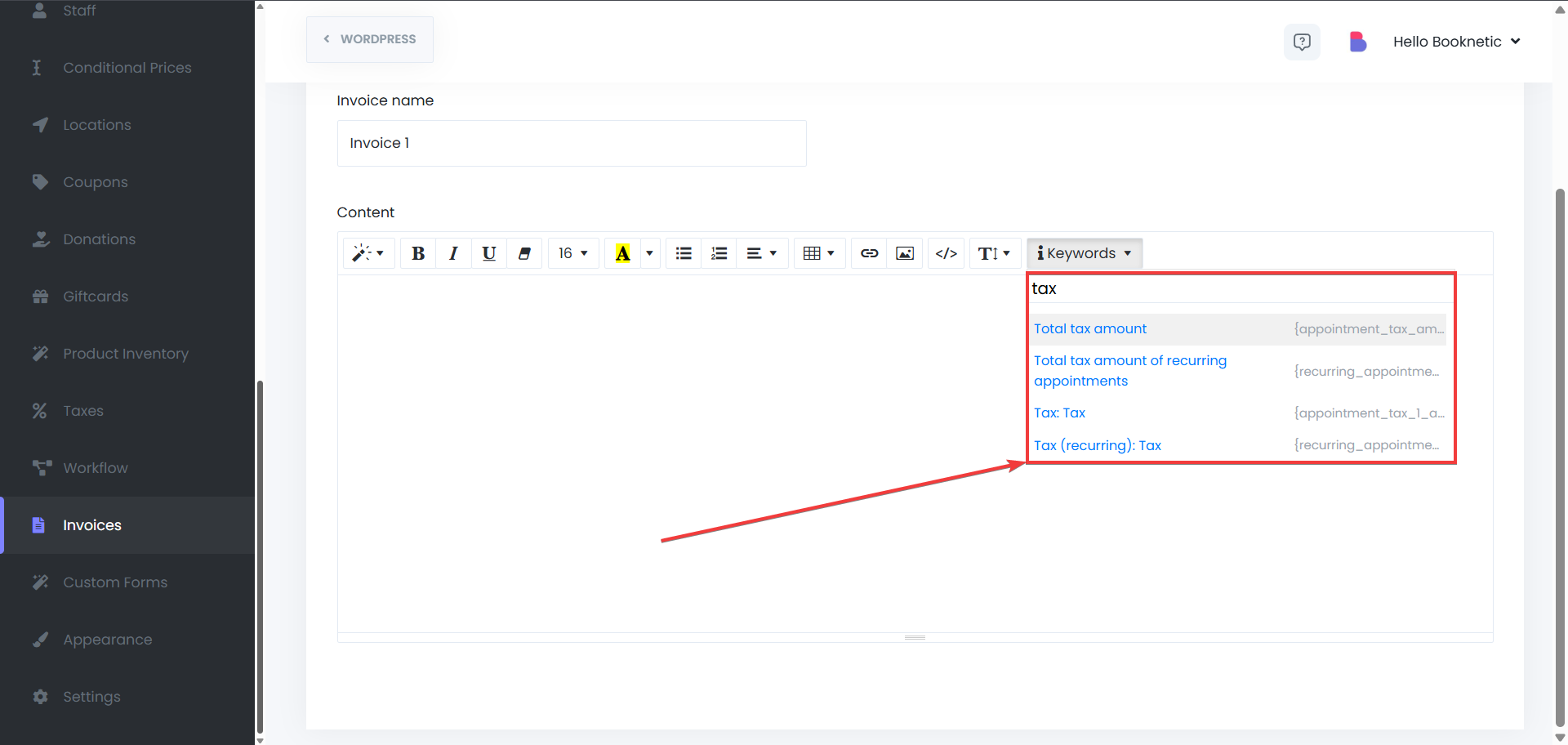

Invoices

You can automatically include taxes in invoices generated for each appointment. The tax amount will be displayed clearly on the invoice for transparency.

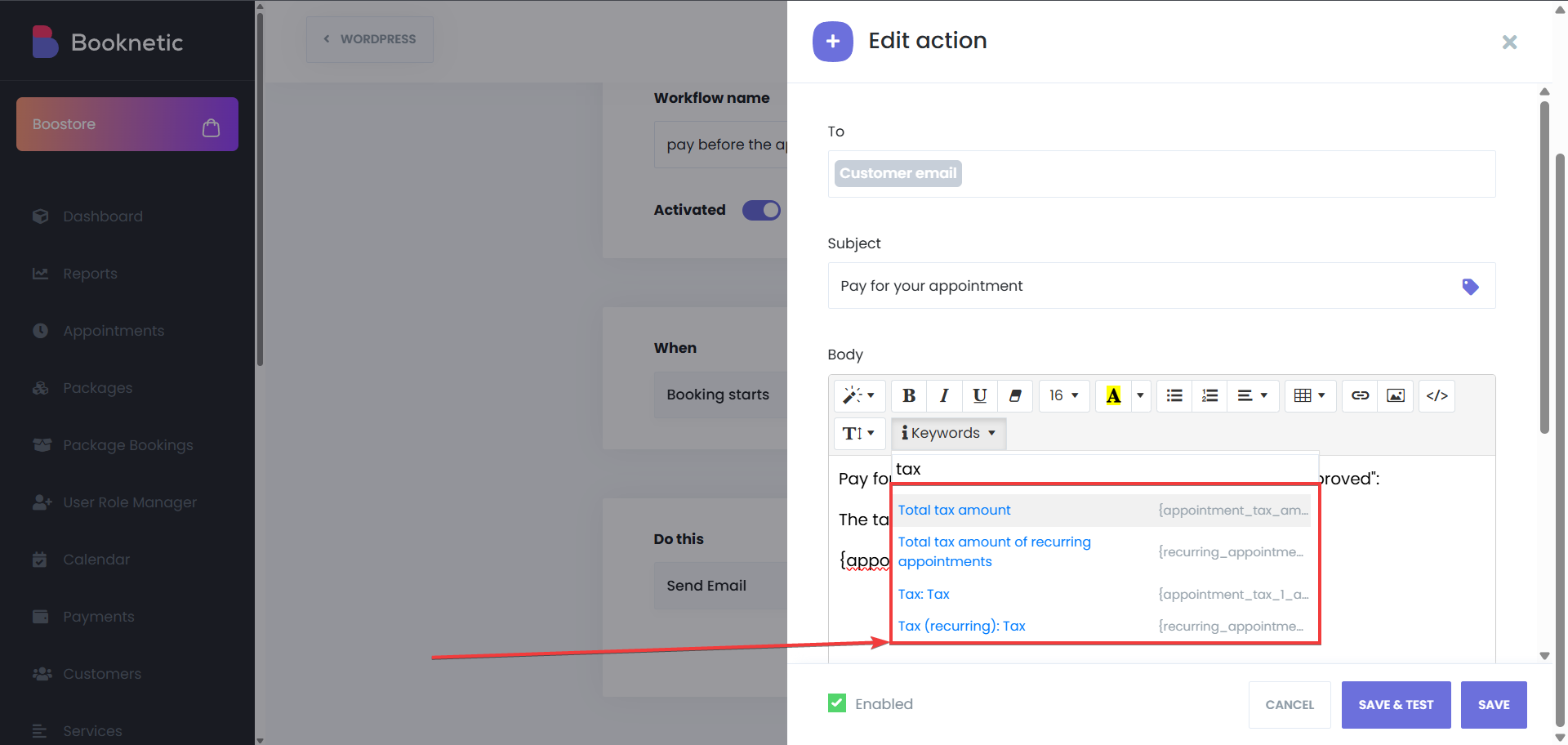

Notifications

Use the keyword {appointment_tax_amount} to show the tax amount in your appointment notification emails, SMS, or WhatsApp messages. This ensures customers are aware of the tax charged on their services.

Accurate and Automated Tax Calculation

Taxes are automatically applied to services based on location, service type, and other criteria.

Multiple Tax Rules

You can configure different tax rules for various services, locations, and time periods, making it easier to manage diverse tax requirements.

Transparency and Compliance

Taxes are clearly displayed to customers, helping you maintain transparency and ensuring compliance with tax laws.

Flexibility

Set custom tax rates, usage limits, and timeframes to match your business needs and regulations.